Administration of Estates

Compassionate Guidance in Times of Loss

Navigating the death of a loved one is never easy. At Young Law, we offer compassionate, efficient, and highly professional legal support for individuals managing the distribution of a deceased person’s estate in Jamaica. Whether the person passed with or without a will, our team is here to guide you through the complexities of probate, letters of administration, and estate planning with clarity and care.

Our Estate Services Include:

Drafting and validation of wills

Applying for Grants of Probate (if a will exists)

Securing Letters of Administration (if no will exists)

Estate planning and succession advice

Representation before the Supreme Court of Jamaica

Property transfers and trust structuring

Legal Framework

Under the Probate and Administration Act (Jamaica), executors (named in a will) or administrators (appointed when no will exists) must apply through the Supreme Court for authority to handle the deceased’s estate. The process includes submitting an inventory of assets, clearing any debts or taxes, and distributing assets to beneficiaries.

In cases of intestacy (no will), the Intestates’ Estates and Property Charges Act outlines how the estate is to be distributed among surviving family members.

Why Choose Young Law?

Experienced in Court Filings: From document gathering to probate applications, we manage the entire process.

Sensitive Representation: We provide legal support that is both knowledgeable and empathetic during emotional times.

Efficient Turnaround: Our team expedites filings and liaises directly with the Registrar of the Supreme Court to minimize delays.

Cross-Border Support: We serve local and international clients managing estates in Jamaica.

FREQUENTLY ASKED QUESTIONS (FAQS)

What happens if someone dies without a will in Jamaica?

If there is no will, the estate is considered "intestate" and is distributed according to the Intestates’ Estates and Property Charges Act. This usually prioritizes spouses, children, parents, and siblings. The court appoints an administrator to manage and distribute the estate.

How long does the estate administration process take?

The timeline varies depending on the complexity of the estate and the documentation available. A straightforward estate can take 4 to 9 months, while more complex or disputed estates can take a year or more.

Are there taxes on inherited property in Jamaica?

There is no inheritance tax in Jamaica. However, transfer tax and stamp duty may apply when transferring real estate from the estate to beneficiaries.

Can I contest a will if I believe it's invalid?

Yes. Grounds for contesting a will include lack of testamentary capacity, undue influence, fraud, or improper execution. If successful, the court may void the will or revert to intestate succession rules.

What are the costs associated with estate administration?

Costs include legal fees, court fees, publication notices, stamp duty, and executor or administrator expenses. At Young Law, we provide transparent fee structures and guidance on what to expect from the start.

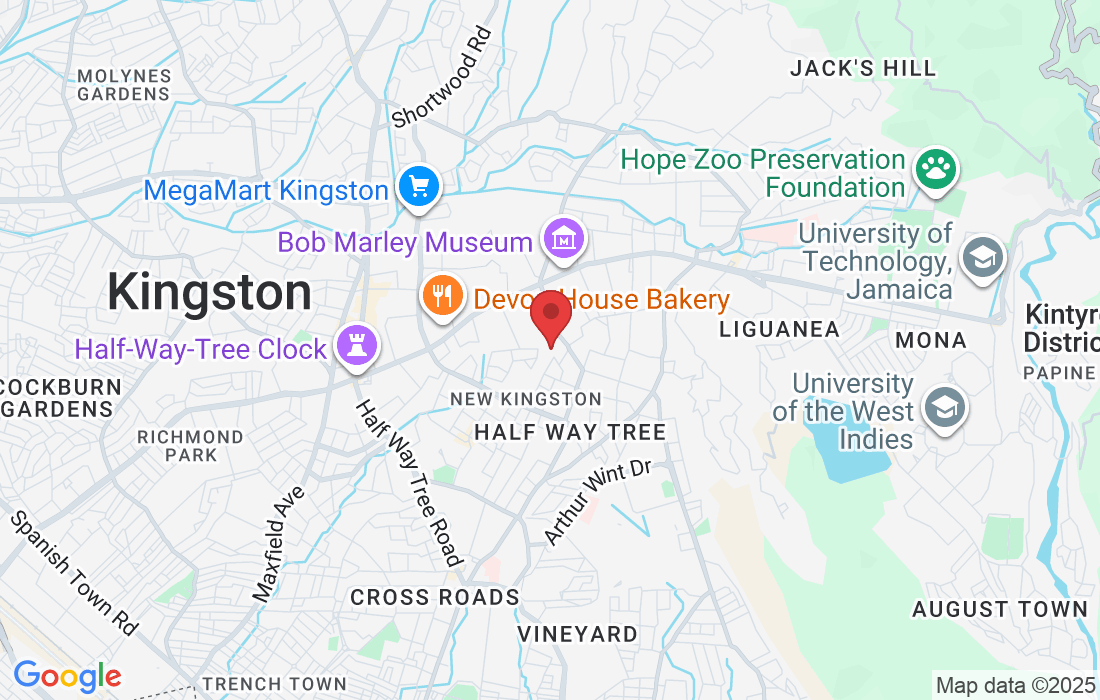

Address:

Unit 14, Braemar Suites

1D-1E Braemar Avenue

Kingston 10, Jamaica W.I.

Our Address:

Unit 14, Braemar Suites

1D-1E Braemar Avenue

Kingston 10, Jamaica W.I.