Real Estate Law

Securing the Property You Call Home—or Build Your Empire On

Buying or selling real estate in Jamaica involves legal intricacies that require expert guidance. At Young Law, we specialize in helping individuals and businesses navigate the full real estate transaction cycle—from purchase agreements to title transfers—with confidence and legal clarity.

Legal Framework

Real estate transactions in Jamaica are governed by The Registration of Titles Act, The Conveyancing Act, and related land development and building codes. Whether purchasing a beachfront villa, selling commercial property, or subdividing land, proper legal oversight is critical to ensure a clear title, secure financing, and smooth registration.

Foreign nationals and overseas Jamaicans can own property in Jamaica, but must comply with tax regulations, stamp duty, and registration requirements through the National Land Agency (NLA).

Young Law supports clients through the entire lifecycle of real estate transactions, including:

Title searches

Contract drafting

Conveyancing

Escrow and closing procedures

Transfer tax and stamp duty compliance

We also advise on:

Development agreements

Construction contracts

Property disputes and encroachments

From MoBay to Mandeville—whether it’s your dream home or next investment—we secure your real estate interests with the diligence they deserve.

Our Real Estate Services Include:

Drafting and reviewing Agreements for Sale

Conducting title searches and due diligence

Handling property transfers through the National Land Agency

Preparing mortgages and discharge documents

Managing boundary disputes and restrictive covenant issues

Facilitating land registration under the Registration of Titles Act

Advising on adverse possession claims and squatter rights under the Limitation of Actions Act

Whether you’re acquiring your first home, investing in commercial property, or resolving a complex dispute, our team ensures your interests are legally protected at every step.

Why Choose Young Law?

Transaction Expertise: We ensure contracts and transfers are airtight and compliant

Risk Mitigation: We uncover encumbrances, liens, or title issues before you sign

Bespoke Solutions: From strata arrangements to agricultural holdings, we tailor solutions to your goals

Reputation & Results: Our proven track record makes us a trusted name in Jamaican property law

FREQUENTLY ASKED QUESTIONS (FAQS)

What documents are required to transfer property in Jamaica?

The key documents include the Agreement for Sale, Certificate of Title, Instrument of Transfer, TRNs for both parties, proof of payment for stamp duty and transfer tax, and valid identification.

How long does the property transfer process take?

On average, a standard property transfer can take 60 to 90 days. However, delays may occur if taxes are unpaid, title issues arise, or document submission is incomplete.

What taxes are involved in property transfer?

Transfer Tax 2% of sale price (or value assessed by the tax authority) payable by Seller; stamp duty presently J$5,000 split between seller and buyer; Title Registration Fee 0.5% of sale price split between seller and buyer.

Can foreigners own property in Jamaica?

Yes. There are no restrictions on foreign ownership of land in Jamaica. However, foreign purchasers must obtain a Jamaican Taxpayer Registration Number (TRN).

Why is a title search important?

A title search reveals the legal owner of the land, checks for liens, encumbrances, or disputes, and ensures that the seller has a right to sell. It is an essential part of due diligence to protect your investment.

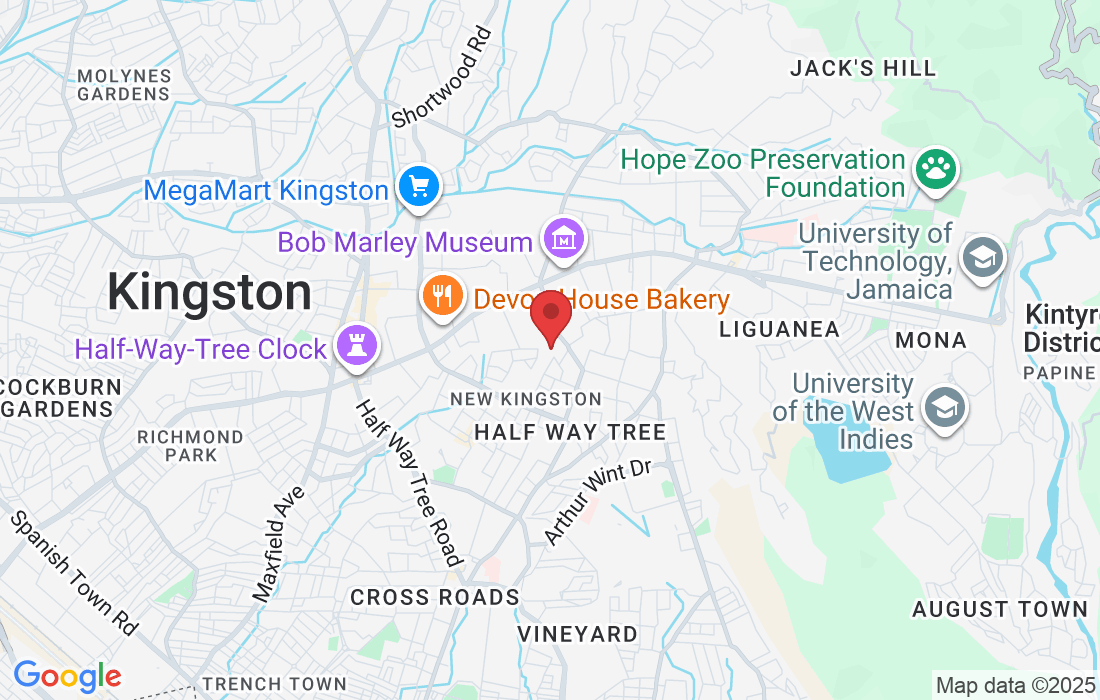

Address:

Unit 14, Braemar Suites

1D-1E Braemar Avenue

Kingston 10, Jamaica W.I.

Our Address:

Unit 14, Braemar Suites

1D-1E Braemar Avenue

Kingston 10, Jamaica W.I.